Lemonade isn’t just a refreshing drink on a hot day – it’s also a revolutionary insurance company shaking up the industry. Founded on the belief that insurance can be fair, transparent, and even charitable, Lemonade offers a variety of coverage options with a unique approach that’s attracting millions. But is it right for you? Let’s dive into the world of Lemonade insurance and see how it stacks up against the competition.

Hey Fellas! Why Choose Lemonade Insurance?

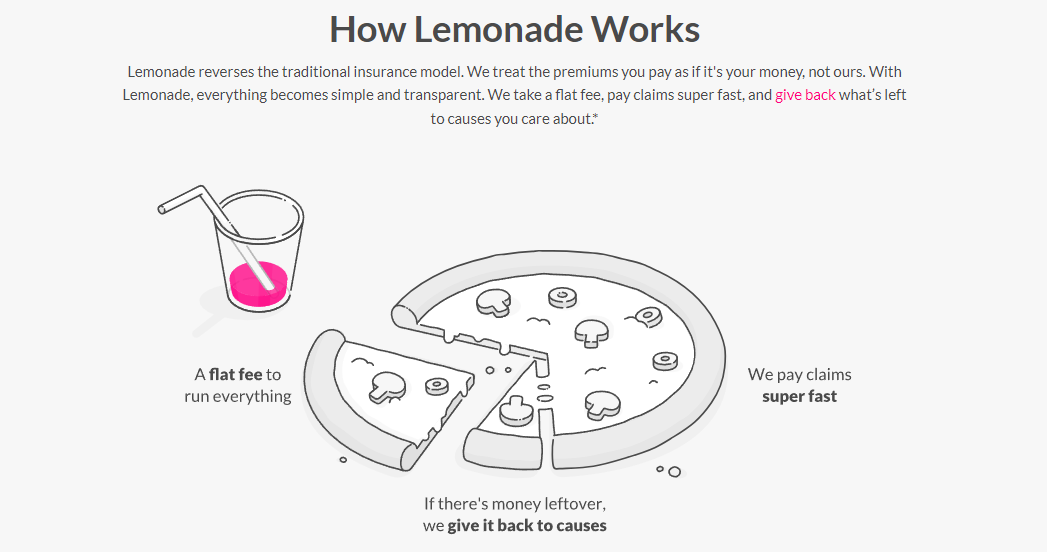

- Disrupting the Status Quo: Lemonade throws away the stuffy old insurance model. They treat your premiums like your money, not theirs. Here’s what sets them apart:

- Tech-Powered Efficiency: Lemonade uses AI and chatbots to streamline the process, from getting a quote to filing a claim. This means faster service and potentially lower costs.

- Give Back to What You Care About: Lemonade calls it their “Giveback Model.” After paying claims and operating expenses, any remaining money goes towards charities chosen by policyholders.

- Focus on Transparency: Lemonade boasts clear, easy-to-understand policies and pricing. No more hidden fees or confusing jargon.

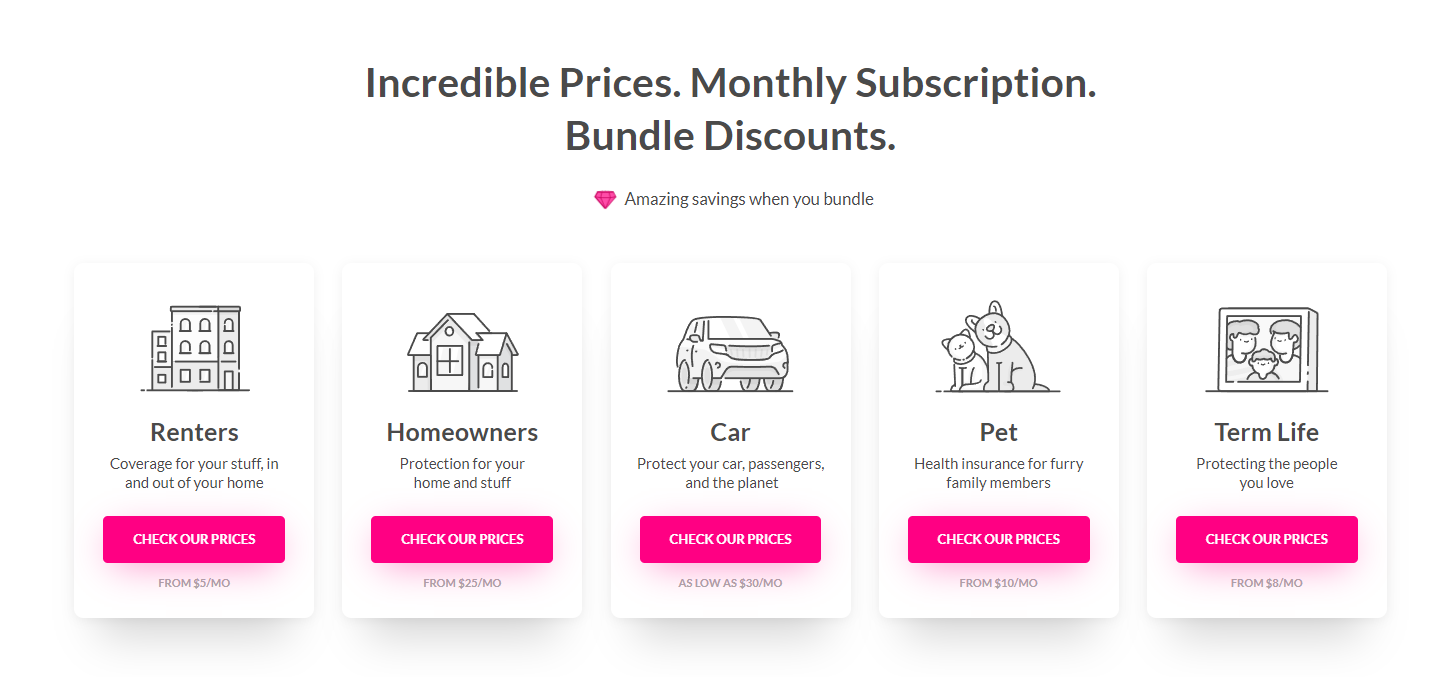

Lemonade Insurance Products

Lemonade offers a variety of insurance options to fit your needs:

- Renters Insurance: Protect your belongings and yourself from unexpected events like fire, theft, or water damage.

- Homeowners Insurance: Safeguard your castle, whether you own a condo, townhouse, or single-family home.

- Car Insurance: Get coverage for your car, from liability to comprehensive, with Lemonade’s user-friendly app.

- Pet Insurance: Our furry friends need protection too! Lemonade offers pet insurance to help cover vet bills in case of accidents or illnesses.

- Term Life Insurance: This policy provides financial security for your loved ones in the event of your passing.

Getting a Quote and Buying Lemonade Insurance

Lemonade makes getting a quote and purchasing a policy refreshingly simple. Here’s how it works:

- Download the Lemonade App: Available on iOS and Android, the app guides you through the quick quote process.

- Answer a Few Questions: Lemonade asks questions about your situation to determine your risk profile.

- Get Your Personalized Quote: In minutes, you’ll receive a transparent quote with no hidden fees.

- Purchase Your Policy: If the quote fits your budget, you can easily buy your policy through the app.

Pros and Cons of Lemonade Insurance

Pros:

- Tech-driven efficiency: Faster quotes, claims processing, and potentially lower costs.

- Giveback Model: Your premiums can support causes you care about.

- Transparent pricing: No hidden fees or complicated jargon.

- Easy-to-use app: Manage your policy and file claims on the go.

Cons:

- Limited availability: Lemonade isn’t available in all states yet. (Focus Keyword: Lemonade Insurance)

- New company: As a relatively young company, their long-term track record is still being established.

- Reliance on AI: Some may prefer human interaction, especially when filing a complex claim.

Lemonade Insurance vs. Traditional Insurance

Lemonade

- Tech-driven: Streamlined process, AI-powered claims processing

- Transparent: Clear pricing, easy-to-understand policies

- Giveback Model: Premiums can support charities

Traditional Insurance

- Paper-based: More complex process

- Opaque pricing: Hidden fees and confusing language

- No charitable giving: Premiums go to profit margins

The Future of Lemonade Insurance

Lemonade is experiencing rapid growth, and with their innovative approach, they’re poised to disrupt the insurance industry further. Here are some potential future developments:

- Expansion into new markets: Lemonade is likely to expand into more states and potentially even offer new insurance products.

- Continued focus on technology: Expect even further advances in AI and machine learning to improve efficiency and personalize policies.

- Increased competition: As Lemonade gains traction, traditional insurance companies are likely to take notice. Here’s what this could mean:

- Improved offerings from traditional companies: Expect to see established insurance companies streamline their processes, offer more user-friendly online options, and potentially re-evaluate their pricing structures to stay competitive.

- More innovation across the board: With increased competition, both Lemonade and traditional companies may invest more heavily in technological advancements and new products to attract customers.

- Potential for consolidation: As the market gets crowded, mergers and acquisitions between insurance companies could occur to create larger, more competitive entities.

This increased competition ultimately benefits consumers by driving innovation, potentially lowering costs, and offering a wider range of insurance options.

Information on the Web and Internet

Lemonade leverages the power of the web and internet to provide a seamless insurance experience. Here’s how:

- Website: The Lemonade website https://www.lemonade.com/ offers comprehensive information about their products, pricing, and claims process.

- Online Community: Lemonade fosters a community spirit through their website and social media. Policyholders can connect, share experiences, and learn from each other.

- Data Security: Lemonade prioritizes online security to protect user data. They utilize industry-standard encryption and security measures.

10 Frequently Asked Questions About Lemonade Insurance

- Is Lemonade Insurance reliable?

Lemonade is a licensed insurance carrier, so your coverage is secure. However, as a newer company, their long-term track record is still developing.

- How does the Giveback Model work?

After paying claims and operating expenses, any remaining money from your premiums goes towards a pool. Policyholders then choose charities they want to support, and Lemonade distributes the funds.

- Can I file a claim online?

Yes! Lemonade’s app makes filing claims quick and easy. You can upload photos and documents directly through the app.

- What happens if I need to cancel my policy?

Lemonade allows you to cancel your policy at any time. You’ll receive a refund for any unused portion of your premium.

- Is Lemonade Insurance cheaper?

Lemonade’s focus on efficiency and technology can potentially lead to lower costs. However, your individual rates will depend on your specific situation.

- How long does it take to get a quote?

Getting a quote through the Lemonade app typically takes just a few minutes.

- Does Lemonade offer discounts?

Lemonade offers several potential discounts, such as bundling multiple policies or having safety features on your home or car.

- What if my claim is denied?

Lemonade will provide clear explanations for any claim denials. You can also appeal the decision if you disagree.

- How does Lemonade protect my privacy?

Lemonade takes data security seriously and uses industry-standard encryption to protect your personal information.

- How can I learn more about Lemonade Insurance?

Visit the Lemonade website https://www.lemonade.com/ or download their app for more information.

Finally

Lemonade is a breath of fresh air in the insurance industry. With their focus on technology, transparency, and giving back, they offer a compelling alternative to traditional insurance companies. Whether you’re a renter, homeowner, car owner, pet parent, or looking for life insurance, Lemonade is worth considering. While their newness in the market might be a concern for some, their innovative approach and rapid growth suggest a bright future. So, ditch the lemons and embrace Lemonade insurance for a potentially sweeter insurance experience.