The Power of Six Sigma in Stock Trading: Boosting Efficiency and Driving Growth

In the fast-paced world of stock trading, where split-second decisions can lead to significant gains or losses, traders and investors are always on the lookout for methods to optimize their strategies and reduce risks. One such method gaining traction is Six Sigma, a business management philosophy that focuses on improving process efficiency, reducing errors, and driving growth through data-driven decision-making. Originally developed in manufacturing, Six Sigma has been successfully applied in various fields, including stock trading, to enhance performance and achieve better results.

What Is Six Sigma?

Six Sigma is a methodology designed to improve business processes by identifying and eliminating the causes of defects or inefficiencies. The term “Six Sigma” refers to achieving a level of performance where the number of defects is minimal — specifically, no more than 3.4 defects per million opportunities. This focus on precision and consistency makes Six Sigma an appealing framework for industries like stock trading, where even minor missteps can lead to significant financial losses.

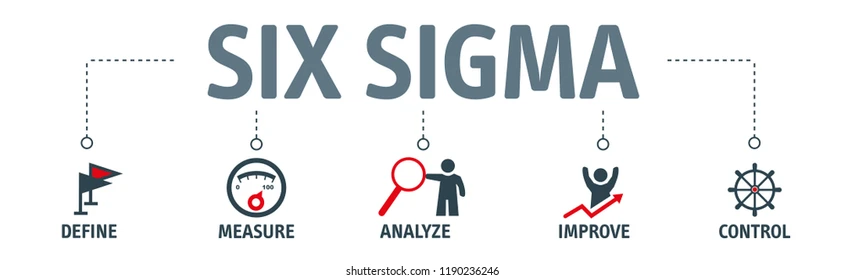

The core principles of Six Sigma are:

- Defining: Identifying the goals and problems that need addressing.

- Measuring: Gathering data to understand the current state of the process.

- Analyzing: Analyzing data to pinpoint the root causes of inefficiencies or issues.

- Improving: Implementing solutions to eliminate defects or inefficiencies.

- Controlling: Establishing controls to ensure sustained improvement over time.

How Six Sigma Applies to Stock Trading

While Six Sigma was initially designed for industrial manufacturing, its principles are highly adaptable to the world of finance and stock trading. In trading, Six Sigma can be applied in various ways to optimize processes, reduce risks, and improve overall performance. Below are some of the most significant ways Six Sigma is making an impact in stock trading:

- Reducing Transaction Errors and Enhancing Accuracy

In stock trading, even the smallest error in executing an order or calculating a position can result in substantial financial loss. By applying Six Sigma principles, traders can streamline their operations and reduce the likelihood of errors. For instance:

- Automation: Using automated trading systems that follow predefined algorithms can significantly reduce human error in executing trades. These systems can be fine-tuned using Six Sigma techniques to enhance accuracy and consistency.

- Data Quality: Ensuring that market data feeds and trading systems are error-free is critical for making informed decisions. Six Sigma methodologies can be used to continuously measure and improve the accuracy of the data sources traders rely on.

- Improving Decision-Making Through Data Analysis

At its core, Six Sigma is all about using data to drive decisions. In the world of stock trading, where volatility is a constant challenge, data-driven decisions are essential for success. Six Sigma encourages traders to gather extensive data, measure key performance indicators (KPIs), and analyze historical trends to inform trading strategies.

For example, using Six Sigma’s DMAIC (Define, Measure, Analyze, Improve, Control) approach, traders can:

- Define the trading strategies they want to optimize.

- Measure the effectiveness of their past trades based on factors like return on investment (ROI), risk-adjusted returns, and accuracy of predictions.

- Analyze the reasons behind successful or unsuccessful trades by identifying trends and patterns in the data.

- Improve the strategies by implementing changes, such as adjusting stop-loss orders, position sizes, or asset allocation.

- Control the processes to maintain consistent performance over time.

By analyzing vast amounts of historical data, traders can fine-tune their decision-making process, identify profitable patterns, and minimize losses.

- Risk Management and Minimizing Drawdowns

One of the biggest challenges in stock trading is managing risk. Unforeseen market fluctuations, sudden news events, or geopolitical factors can all lead to significant financial drawdowns. Six Sigma’s focus on process optimization helps traders identify potential risks early, minimize exposure, and protect capital.

- Predictive Analytics: Six Sigma’s emphasis on statistical analysis can be applied to develop models that predict potential market downturns or price swings. Traders can use these insights to adjust their strategies and mitigate risk before significant losses occur.

- Optimization of Stop-Loss and Take-Profit Levels: By analyzing past trade data, traders can optimize their stop-loss and take-profit levels to minimize losses and lock in profits. This helps in reducing the impact of market volatility and improves long-term profitability.

- Enhancing Trading Strategy and Algorithm Development

Algorithmic trading, which uses computer programs to execute trades based on predefined criteria, is another area where Six Sigma principles can be highly effective. By applying Six Sigma techniques to algorithmic strategies, traders can improve the performance of their algorithms and ensure they consistently produce desired results.

- Optimization of Trading Algorithms: Six Sigma methodologies can be used to continuously improve the performance of trading algorithms by identifying bottlenecks or inefficiencies in the system. Data-driven optimization techniques can help improve the accuracy of trade executions, reduce slippage, and enhance profitability.

- Backtesting: Using Six Sigma, traders can conduct thorough backtesting of trading strategies, which involves running algorithms on historical data to assess their potential effectiveness. This helps identify flaws in the strategy before deploying it with real capital.

- Continuous Improvement and Adaptation to Market Conditions

Stock markets are dynamic and constantly evolving. What worked well last year may not work today, and traders must continuously adapt their strategies to changing market conditions. Six Sigma’s focus on continuous improvement allows traders to fine-tune their strategies regularly and stay ahead of the curve.

- Performance Reviews: Six Sigma’s emphasis on measurement and control means that traders are consistently reviewing the performance of their trades. By regularly assessing the outcomes, traders can quickly identify areas for improvement and make data-driven adjustments.

- Flexibility and Adaptability: Six Sigma allows for a flexible approach that adapts to changing market conditions. Traders can use real-time data to adjust their risk management rules, trading parameters, or asset allocation to remain competitive.

The Impact of Six Sigma on Growth in Stock Trading

When applied effectively, Six Sigma can drive significant growth in stock trading by improving process efficiency, reducing errors, and enhancing decision-making. Here’s how:

- Consistency in Profitability: By reducing errors and optimizing trading strategies, traders can achieve more consistent profitability over time.

- Reduced Costs: With fewer transaction errors and better risk management, the cost of trading, including commissions, slippage, and losses, can be minimized, leading to higher overall returns.

- Scalability: Traders who apply Six Sigma principles can scale their operations more effectively, whether that means increasing the volume of trades or expanding into new asset classes.

- Increased Confidence: By implementing a systematic, data-driven approach, traders can make more informed decisions, leading to greater confidence in their trading strategies.

Conclusion

Six Sigma is a powerful tool for optimizing stock trading strategies, enhancing decision-making, and improving risk management. By focusing on reducing inefficiencies, minimizing errors, and leveraging data to drive decisions, traders can achieve more consistent and profitable results. Whether applied to manual trading, algorithmic strategies, or risk management, Six Sigma provides a framework that can help traders navigate the complexities of the financial markets and ultimately drive growth in their trading operations. As the financial landscape becomes increasingly competitive, traders who adopt Six Sigma principles may find themselves at a distinct advantage, poised for long-term success.